Cost-of-Living Adjustments

General Information about Cost-of-Living Adjustments (or COLA’s)

- There is no guarantee that a new COLA will be granted in any given year.

- 10.2% of employee contributions are allocated to a separate COLA Account that was established in 1977 for the purpose of funding approximately one half of each COLA granted. The employer pays the remainder of each increase. The new COLA granted each year is limited to the extent that the COLA Account is, in the opinion of our actuary, able to afford it.

- The first COLA adjustment is made in the thirteenth month after retirement, and each July thereafter.

- Pensioners who have been retired for more than 13 months but less than 18 months at July 1 (i.e, retired between January 1 and June 30 in the prior calendar year) will receive a partial increase.

- A pensioner’s COLA increase is calculated on the pension amount before conversion to an optional form of payment (or in other words, on the lifetime pension) and on previously granted COLA’s. Therefore, a pensioner cannot always apply the COLA increase to the pension in pay to come up with the increased pension.

- The new COLA each year is based on the increase in the CPI for Canada over the prior calendar year. COLA’s cannot exceed 2/3 of the CPI increase unless, in the opinion of the actuary, the COLA Account is able to pre-fund all required COLA payments for the next 20 years. It is not anticipated that this pre-funding level will be achieved.

- When a pensioner dies and a pension continues to a spouse, common-law partner or other beneficiary, COLAs reduce to 2/3 regardless of the pension option selected for the basic pension.

- See a history of CSSB COLA percentages since 1977.

- See the actuary’s valuation reports for the COLA Account.

Cost-of-Living Adjustments May Be Reduced in Future If Inflation Rises

The actuary has continued to express concern that, unless changes are made to the COLA program, the COLA Account will not be able to meet the target of granting additional COLA’s each year at the rate of 2/3 of the increase in the Consumer Price Index. The Board shares this concern.

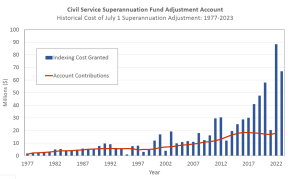

When the COLA Account was established in 1977, there were 24,007 contributing employees, compared to 2,890 pensioners. At the end of 2021, the number of contributing employees has grown about 10%, to 26,636. The number of pensioners has grown to 24,173, an increase of more than 730%.

The following graph illustrates the increase in the cost of providing new COLA’s each year compared to the contributions being allocated to the COLA Account:

The Superannuation and Insurance Liaison Committee (Liaison Committee), which represents plan members in negotiating plan benefits, is also concerned with the sustainability of the COLA Account.

Concerned members should contact the Liaison Committee.

Are Previously Granted COLA’s at Risk?

When considering COLA increases, it’s important to distinguish between increases that have been granted to date and new COLA’s that could be granted in future years.

Additional funding is not required in order to continue to pay the COLA’s that have been granted to date. The pension plan’s portion of the COLA’s granted to date is already funded. The employer’s portion is promised, and employers don’t have the option to cease this funding.